Market View

The distrust is rooted in the secondary mortgage market, in which thousands of residential mortgage loans were originated and then sold and assigned to successor lenders and/or trustees, sometimes multiple times. The documentation for many of these assignments was sloppy or nonexistent — giving rise to numerous robo-signing scandals and judges across the country who took it upon themselves to crusade against banks within the foreclosure process.

All of this resulted in a much slower and more expensive mortgage foreclosure process — and raised mortgage costs more generally. The current practice of requiring title insurance for all mortgage loans also adds complexity and cost to the mortgage lending process.

Homelend Vision

Homelend will transform mortgage origination into a simpler, more efficient and fair process, reducing the distance between borrowers and lenders in a way no solution has done before.

Why Homelend

Homelend is being developed as a blockchain solution that will significantly increase the housing financing possibilities for many individuals and families.

Our value proposition is socially sensitive and anchored in a P2P progressive approach that aims to use technology for society’s benefit.

Our value proposition is socially sensitive and anchored in a P2P progressive approach that aims to use technology for society’s benefit.

Nonetheless, Homelend is also based on a sound and profitable business model, which consciously reaches out to address an underserved market.

On the one hand, Homelend creates an investment opportunity for many individuals, with a solution that unites a traditional industry as real estate, with an innovative technology like blockchain.

On the one hand, Homelend creates an investment opportunity for many individuals, with a solution that unites a traditional industry as real estate, with an innovative technology like blockchain.

On the other hand, it makes possible for many individuals (who due to various circumstances, including current limitations in the traditional credit risks models, do not possess a solid credit score but are otherwise creditworthy) to access to housing financing and solve one of their most basic aspirations: having a home of their own.

Homelend Advantages

- Homelend is developing an innovative platform that taps into the power of blockchain technology and will disrupt the mortgage industry.

- Opening new P2P funding / investment opportunities, better managing information, and reduce origination costs by automating business processes with the help of smart contracts.

Homelend Platform

Homelend P2P mortgage crowdlending platform works by embedding into smart contracts the business logic of origination processes. This creates a system where borrowers and lenders can interact without the need of a trusted financial intermediary.

The Platform Features

- P2P Lending and the Mortgage industry

- Homelend’s P2P mortgage lending mechanism

- P2P lending methods

- Closing and mortgage deed assignment

The Token

- Homelend opens an opportunity for P2P lending in several main cryptocurrencies.

This feature aims to broaden financing possibilities. However, access to services provided by the platform through different cryptocurrencies (or fiat currencies) will generate administrative friction costs that can be avoided. - The use of a token, in this case the HMD token, standardizes the access to services provided through the platform, regardless of the cryptocurrency in which the loan is extended or the country where it takes place. It also hedges the Homelend platform against volatility from cryptocurrencies.

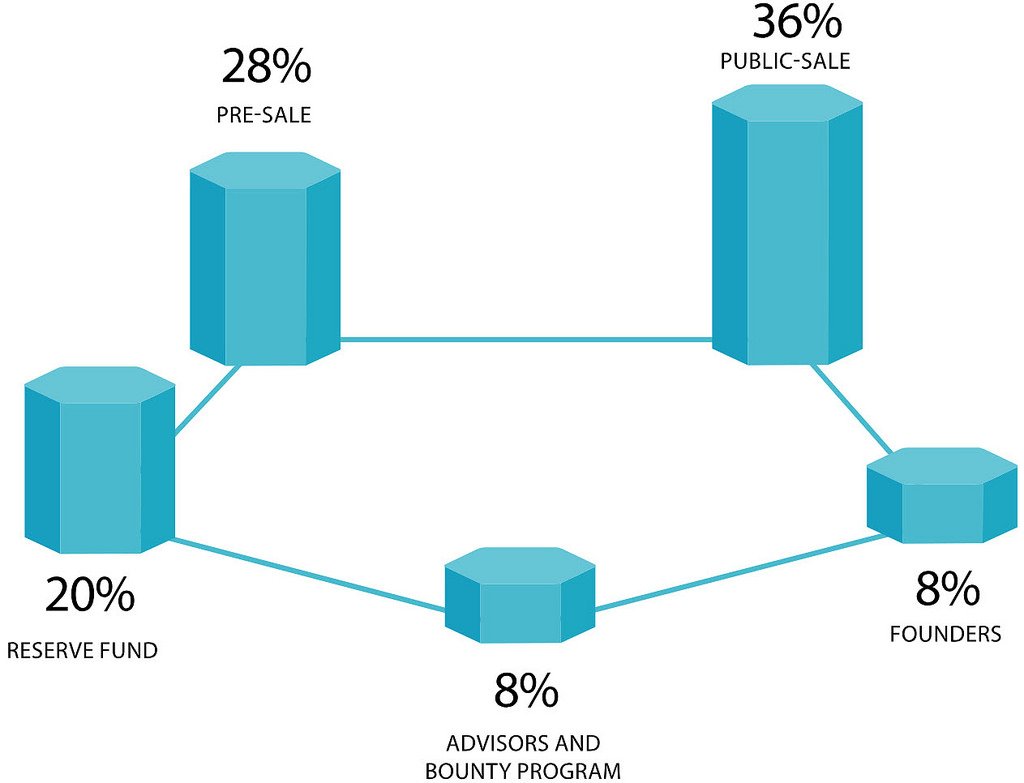

Token Allocation

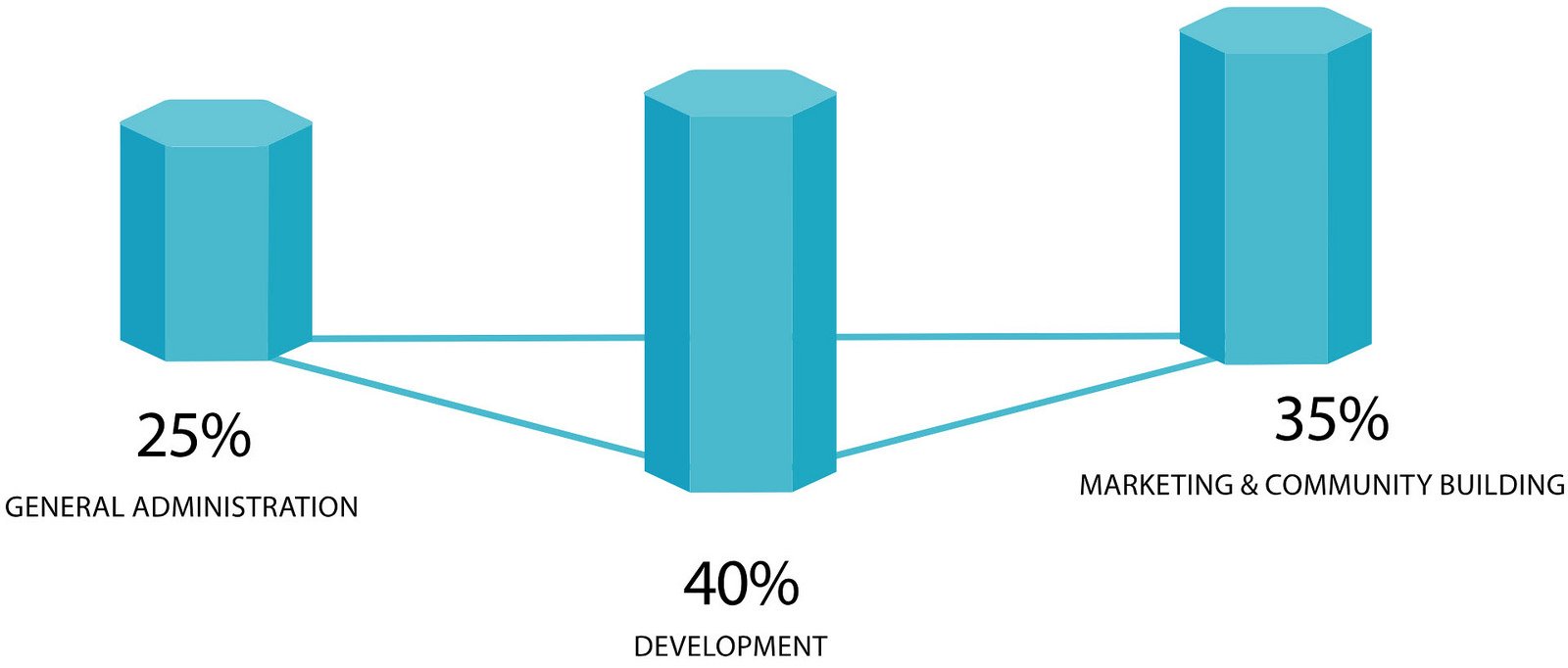

Token Usage

Finally

Blockchain technology may radically alter the process through which consumers buy a home, as well as the way financial institutions handle mortgages. Specifically, the technology could remove cost and friction from the process, create transaction records that are infallible and incorruptible, and jurisdiction near-instantaneous settlement. It could also dramatically change the way mortgages are serviced and sold on the secondary market.

✅Website: https://homelend.io/

✅Whitepaper: https://homelend.io/files/Whitepaper.pdf

✅Twitter: https://twitter.com/homelendhmd

✅Facebook: https://www.facebook.com/HMDHomelend/

✅Reddit: https://www.reddit.com/r/Homelend/

✅Telegram Group: https://t.me/HomelendPlatform/

✅Bitcointalk ANN: https://bitcointalk.org/index.php?topic=3407541

✅Whitepaper: https://homelend.io/files/Whitepaper.pdf

✅Twitter: https://twitter.com/homelendhmd

✅Facebook: https://www.facebook.com/HMDHomelend/

✅Reddit: https://www.reddit.com/r/Homelend/

✅Telegram Group: https://t.me/HomelendPlatform/

✅Bitcointalk ANN: https://bitcointalk.org/index.php?topic=3407541

Author of article:

✅Bitcointalk username: Erik_Smuel

✅Bitcointalk profile link: https://bitcointalk.org/index.php?action=profile;u=2020517

✅Bitcointalk username: Erik_Smuel

✅Bitcointalk profile link: https://bitcointalk.org/index.php?action=profile;u=2020517

No comments:

Post a Comment