Present-day financial services mainly consist of financing, investment management & advisory, trading and insurance. When it comes to trading and financing, the current financial system lacks in efficiency and transparency. The market entry complications that are facing investors and the service fees that they are charged are quite substantial, which is why some of these investors get discouraged from actively participating in the current market. Additionally, smaller investors get overlooked in favor of bigger and wealthier investors and thus, combined with the lack of trust in the markets that increased after the 2008 crisis, the global financial market is prevented from reaching optimal efficiency.

The Blockchain Technology

The blockchain is an undeniably ingenious invention, the brainchild of a person or group of people known by the pseudonym, Satoshi Nakamoto. But since then, it has evolved into something greater, and the main question every single person is asking is: What is Blockchain?

The blockchain is an incorruptible digital ledger of economic transactions that can be programmed to record not just financial transactions but virtually everything of value.

By allowing digital information to be distributed but not copied, blockchain technology created the backbone of a new type of internet.

The blockchain is an incorruptible digital ledger of economic transactions that can be programmed to record not just financial transactions but virtually everything of value.

By allowing digital information to be distributed but not copied, blockchain technology created the backbone of a new type of internet.

Why Bitex Using the Ethereum blockchain

- Blockchain-based solutions built on Ethereum, using public distributed ledgers, cryptotokens and smart contracts offer participants a means of creating value through trusted and transparent interactions on a global scale. This structure is particularly suited for the creation of a banking platform.

- At any point in time, a DApp on the Ethereum blockchain maintains the complete state of all the accounts and the transactions these invoked since the creation of the system. Such an account-based system (as opposed to a purely transaction-based system such as Bitcoin) allows for the creation of more complex interactions where accounts (representing the end users behind them) can execute and record via smart contracts a variety of irrevocable computation steps that mimic aspects of human constructs such as legal, financial or business agreements.

- Various straightforward financial constructs such as escrows, disbursements, etc., can be carried out on the Ethereum blockchain in a transparent and automated way directly between the participants without the need to involve entities outside the system or rely on any centralized entity.

- This lack of intermediaries and the ability to create irrevocable code to take the place of fallible human behavior and interactions allows for much lower costs, reduced transaction times, accuracy and non-repudiation. Traditional banking has much larger costs associated with providing such functions.

The Main Components of The Bitex Crypto-Banking Platform

The following subsections describe the stakeholders/participants in the Bitex cryptobanking ecosystem and the service available to or provided by each. The two main components of the Bitex crypto-banking platform are:

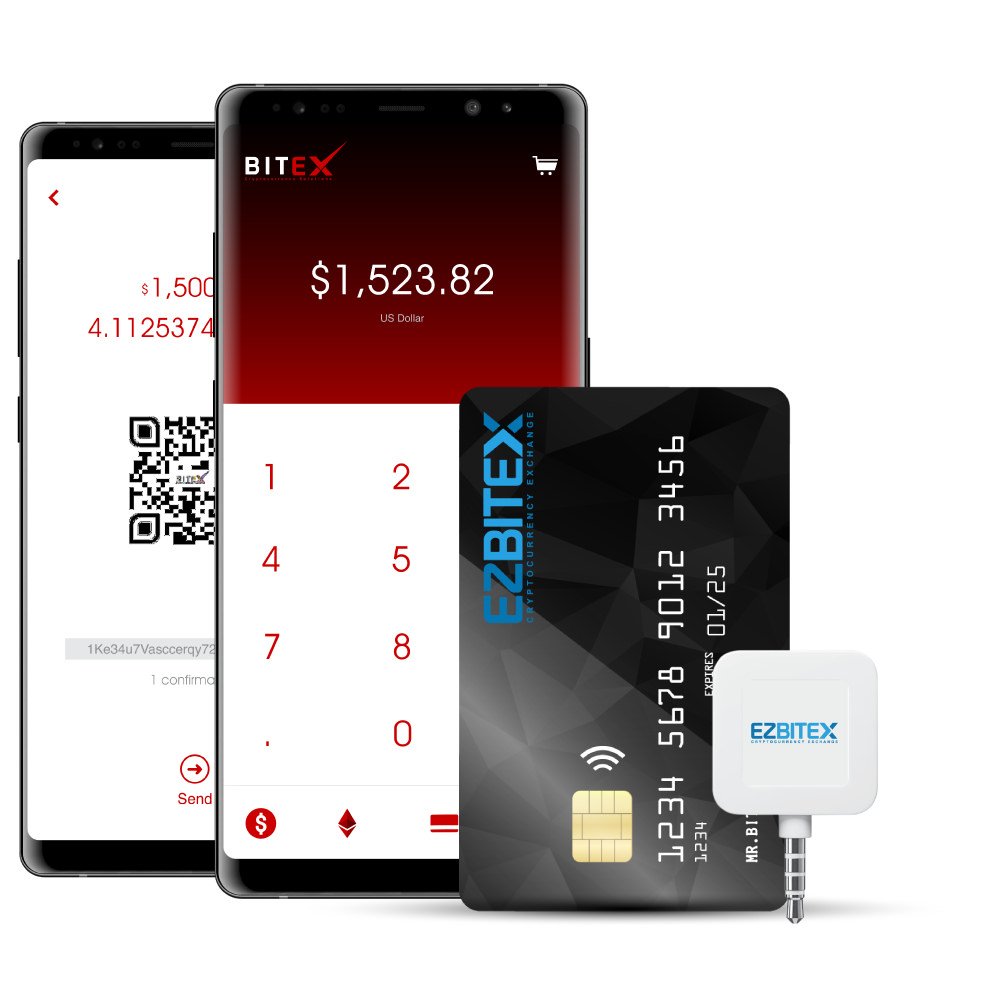

- BitexPay, the next generation payment solution for both consumers and merchants; and

- EZBitex, the currency exchange and banking infrastructure with a decentralized, distributed and immutable ledger provided by Bitex, which underpins the functioning of the entire system.

The function of each of these is described systematically in the following subsections from the point of view of the different stakeholders/users of the Bitex system.

What is BitexPay

BitexPay is the next generation payment solution for both consumers and merchants.

The Features of BitexPay

- BitexPay represents the service offered by Bitex to consumers and merchants for payment of goods and services using cryptocurrencies.

- Merchants will be able to accept payments in cryptocurrencies or fiat currencies of their choice.

- Consumers who sign onto the BitexPay solution will be provided with ERC-223 compatible wallets that contains their cryptocurrency holdings.

- Initially, Bitex will only support the following cryptocurrencies: BTC, ETH, and LTC and the Bitex Coin, XBX.

- As new currencies are added to the EZBitex exchange, consumers will be informed of the availability of these via mail or social media.

What is EZBitex

EZBitex is the currency exchange and banking infrastructure with a decentralized, distributed and immutable ledger provided by Bitex, which underpins the functioning of the entire system.

The Features of EZBitex

The EZBitex platform will:

- Offer conversions from crypto to crypto, from fiat to crypto and from fiat to fiat all in this one exchange.

- Offer payment gateways (provided by established third parties such as Braintree or Stripe) for the purchase of cryptocurrencies using a credit card, debit card or online banking.

- Host the various types of consumer wallets (Payment, Trading, Staking, Loan) associated with consumer accounts and provide the various services described in earlier sections.

- Provide APIs to access the EZBitex functions to third parties that want to use EZBitex as their payment platform.

- Provide Bitex-branded ATMs in locations where Bitex operates, to allow use of physical and virtual BitexPay cards as well as third party “Powered by Bitex” cards.

- Offer business-to-business payments for goods and services with invoices and receipts.

Finally

The time when cryptocurrencies become first-class citizens of the digital economy is fast approaching — the question is not “if” but “when” this will happen. When that time arrives, the need to provide financial services for this emerging economy will be critical to fuel its growth. Bitex expects to be ready when that time comes by becoming the first locally embedded crypto bank.

✅Website: https://ico.bitex.global/

✅Whitepaper: https://ico.bitex.global/docs/XBX-Token-WhitePaper.pdf

✅Twitter: https://twitter.com/bitex_global

✅Facebook: https://www.facebook.com/bitex.global/

✅Telegram Group: https://t.me/Bitex_Global_Official

✅Whitepaper: https://ico.bitex.global/docs/XBX-Token-WhitePaper.pdf

✅Twitter: https://twitter.com/bitex_global

✅Facebook: https://www.facebook.com/bitex.global/

✅Telegram Group: https://t.me/Bitex_Global_Official

Author of the article:

✅Bitcointalk username: Erik_Smuel

✅Bitcointalk profile link: https://bitcointalk.org/index.php?action=profile;u=2020517

✅My Ethereum Address: 0xA009D96EFB69bC8e328d43c4d18dd9B6d7422BC8

✅Bitcointalk profile link: https://bitcointalk.org/index.php?action=profile;u=2020517

✅My Ethereum Address: 0xA009D96EFB69bC8e328d43c4d18dd9B6d7422BC8

No comments:

Post a Comment