What is Bitex?

Bitex is the first locally-embedded, yet global, crypto-bank.What Bitex Believes?

Bitex believes that it can make the greatest impact on society by working at the local level, and ensuring that the benefits of this new cryptocurrency-based digital economy can also be felt by those under-served or left out of the current banking system. Thus, instead of starting out immediately as a global bank, Bitex wants to ensure that its solution has a local impact.Bitex’s crypto-banking services include:

● Customer care, user experience and governance that is localized.● An ERC-223 compatible digital wallet for securely storing a customer’s cryptocurrency balances on a personal mobile device.

● The ability for using the mobile wallet with a virtual debit card for payments, exchanges and transfers.

● Various Point of Sale solutions (both hardware and software based) for merchants to accept payments in their local currency from consumers.

● Currency exchanges between the G20 fiat currencies and various popular cryptocurrencies.

● Large scale business-to-business payments;

● Personal loans

Bitex Plans

The time when cryptocurrencies become first-class citizens of the digital economy is fast approaching, Bitex expects to be ready when that time comes by becoming the first locally embedded crypto bank. It aims to provide financial services to the cryptocurrency-based digital economy that is relevant and useful to the local customer base in each region where it operates, while being available globally. Bitex will provide cryptocurrency-based banking services for digital customers through a licensed technology platform available to local partners.Bitex has successfully raised $2,760,000 By sales of Franchise License for operating the Regional Bitex platform.

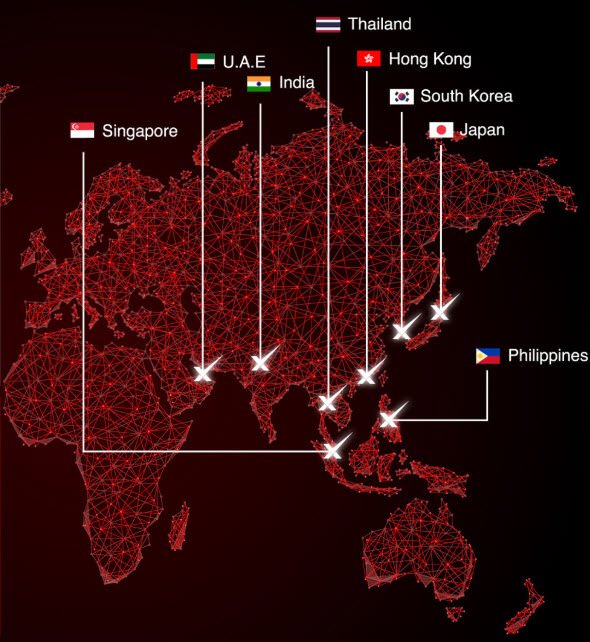

Bitex will launch in mid-2018 with a subset of banking services offered to customers in 8 countries (Hong Kong, India, Japan, Korea, Philippines, Singapore, Thailand and the United Arab Emirates), with plans for expanding its reach in the future. Services will be operated by local partners that license the Bitex platform as a franchise and who will register with the financial authorities in their respective countries. By working with local partners, who have a much better understanding of local customers and regulators and making available localized applications and customer support, the Bitex crypto-banking platform becomes the most accessible crypto-banking solution on the market.

A payment infrastructure based on ATMs and mobile card readers is being developed for the Bitex platform that will be installed in over 20,000 locations throughout the world as the services are rolled out. Bitex will also offer APIs to its platform that will allow 3rd party developers to create useful, country-specific features and applications.

Bitex is conducting an Initial Coin Offering of its utility token, the Bitex Coin with symbol XBX, to promote the use of the Bitex crypto-banking platform. As described in this White Paper, XBX will be used for access to the services offered by the Bitex platform. After the ICO, the token will be available for purchase from other XBX token holders at Bitex’s exchange as well as other well-known crypto exchanges.

Bitex will demonstrate the local impact it will have in each country where it is licensed by offering a relevant localized financial service bundle and redefining how financial services for this new cryptocurrency-based digital economy can be delivered. While there are multiple incumbents in the crypto-banking space, Bitex expects that this hyper-localized strategy will give it an edge in creating, over time, the first truly global crypto-bank for mainstream consumers.

No comments:

Post a Comment