The trouble with cryptocurrency markets is that they are wild, uncharted territory. Few investors have the knowledge to successfully and consistently profit in the market compared to the number of people with experience in much less rewarding traditional markets.

There is a suitable solution for investors who do not want to manage savings on their own: CINDX allows anybody to invest in the crypto market, and earn without specialised knowledge or skills.

Why CINDX

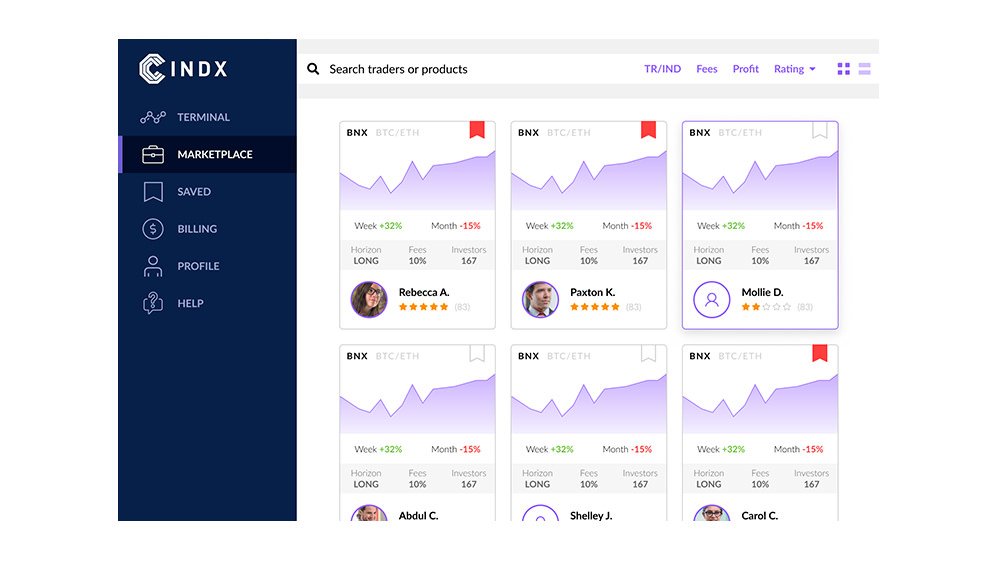

CINDX develops an ecosystem which allows any investor to choose a trader and/or asset manager to manage their portfolio and securely trade their cryptofunds for a reasonable success fee.

Investors can now refer to transparent and verifiable statistics of traders and managers as a way to choose a suitable trading strategy. Statistics include performance history, risk level, type of cryptocurrency traded etc. So investors can find the most suitable trader to manage their assets.

CINDX Ecosystem Features

• CINDX shifts the paradigm of the existing "trader-investor" relationships towards depersonalised fair play solutions. CINDX provides full access to success and failure stats of all asset managers registered in the ecosystem. While the industry suggests selecting a trader/manager based on the average results of its trading. There are no inaccurate values, creative accounting and imposed accountancy - everything is on the blockchain.

• CINDX provides users with a chance to enter the cryptocurrency market and access a multitude of services, including crypto asset management and a social network in a single ecosystem for a reasonable success fee.

• CINDX smart contracts, APls and blockchain technology provide transparency, immutability, and censorship-resistance of all stored information. They make all the processes transparent.

• CINDX security tokens allow users to pay for services in the ecosystem and receive rewards for freezing their tokens with smart contracts. An increase in the number of active users in the ecosystem affects revenue and creates more attractive conditions for token holders. The economy of the ecosystem is designed to reduce the volatility of the market value of the token in the open market.

LOYALTY PROGRAM

CINDX will pay a monthly fee of 30% of the revenue generated in CINDX security tokens to the token holders. The remuneration will be accrued to holders of CINDX security tokens locked through a smart contract thereby encouraging them to keep the token in their portfolio.

MVP & HOW IT WORKS

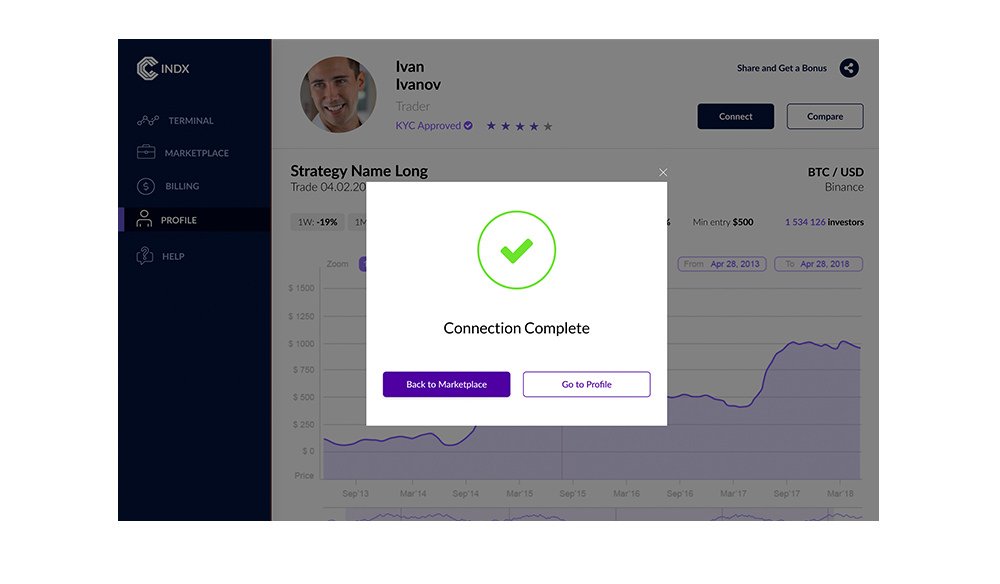

CINDX uses APls as a 'portal', allowing the investor's account to be managed by the chosen asset manager's account. Then the smart contract automatically registers every trade made by the asset manager. And it copies and executes the same trades on the investor's account.

This means that transactions are not just copied in proportion to the size of the investor's portfolio. The Manager sees the exact volume of entry into the trading operation (order) with the funds of investors copying the transaction. CINDX algorithms monitor liquidity on the selected trading pair and warn the Manager about the low volume of DOM (Depth of Market).

In some instances, the system can block the order of the Manager or offer to reduce its volume to avoid slippage and PUMP/DUMP strategies. Although many projects are proposing to provide a similar service in the future, CINDX does have some features that make it stand out.

CINDX is extremely valuable for asset managers, who can now have access to attract more investors than is feasible outside of the ecosystem. CINDX will simplify the process so the manager only has to be concerned with trading, while the investor only has to be involved in choosing their manager. Everything else is automated and fully secure.

Finally

CINDX allows anybody to profit from crypto without the need for skill or previous knowledge in the market, and will help to pave the way towards genuinely automated finances.

Investing in proven value strategies can drastically reduce an investment risk. Investors match what the best asset managers are doing with their money and replicate their actions automatically.

Investing in proven value strategies can drastically reduce an investment risk. Investors match what the best asset managers are doing with their money and replicate their actions automatically.

✅Website: https://cindx.io/

✅Whitepaper: https://drive.google.com/file/d/1uqkaJrSYKNlCriDY_9QC1CVOyDkuw0DJ/view

✅Twitter: https://twitter.com/CindxPlatform

✅Facebook: https://www.facebook.com/cindx.io/

✅Reddit: https://www.reddit.com/r/cindx/

✅Medium: https://medium.com/cindx

✅linkedIn: https://www.linkedin.com/company/cindex-platform/

✅Telegram Group: https://t.me/cindx_official

✅Bitcointalk ANN: https://bitcointalk.org/index.php?topic=4421275.0

✅Whitepaper: https://drive.google.com/file/d/1uqkaJrSYKNlCriDY_9QC1CVOyDkuw0DJ/view

✅Twitter: https://twitter.com/CindxPlatform

✅Facebook: https://www.facebook.com/cindx.io/

✅Reddit: https://www.reddit.com/r/cindx/

✅Medium: https://medium.com/cindx

✅linkedIn: https://www.linkedin.com/company/cindex-platform/

✅Telegram Group: https://t.me/cindx_official

✅Bitcointalk ANN: https://bitcointalk.org/index.php?topic=4421275.0

Author of article:

✅Bitcointalk username: Erik_Smuel

✅Bitcointalk profile link: https://bitcointalk.org/index.php?action=profile;u=2020517

✅Bitcointalk username: Erik_Smuel

✅Bitcointalk profile link: https://bitcointalk.org/index.php?action=profile;u=2020517

No comments:

Post a Comment