In a world of digital transformation, we see great changes happen in how we share information and communicate. There are attempts to digitize many aspects of our daily lives, especially in the world of payments, peer-to-peer lending, remittance, and philanthropy.

There are start-ups trying to focus on a niche and would not take advantage of economies of scale, which is one of the main advantages enjoyed by traditional financial institutions that may not be as technologically advanced. TraXion plans to offer traditional financial products in a blockchain-driven environment, eventually becoming the crypto-economy for payments, peer-to-peer lending, remittances, savings, insurance, investments, and philanthropy.

Why Traxion

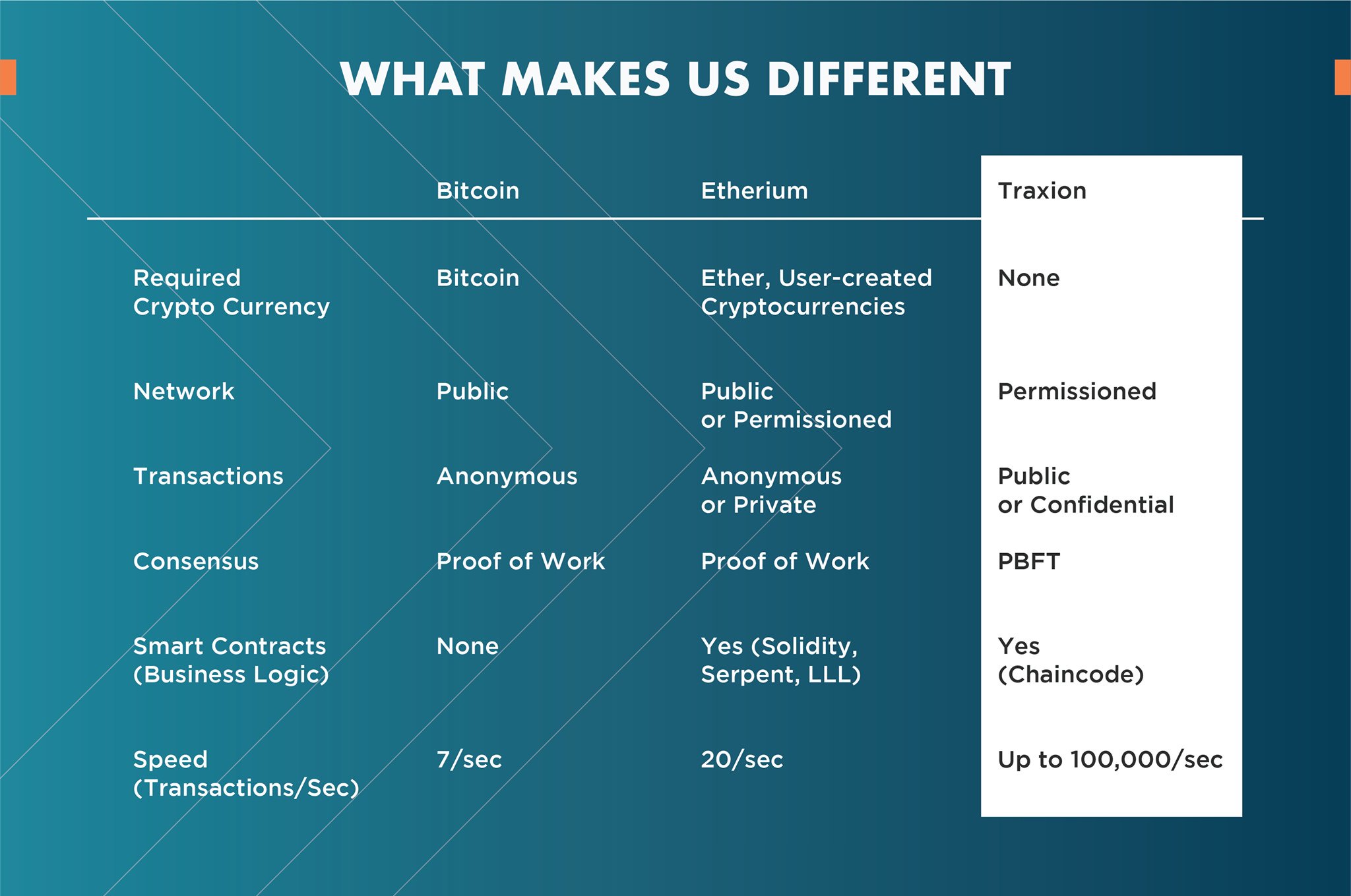

TraXion is building a crypto-economy to last, therefore, the focus will be on the scale, elimination of middlemen, and decentralizing legacy systems. To achieve these goals, TraXion will offer white-label platforms across the globe and connect them in a distributed, permissioned and secured blockchain. It will be used by banks, operators and agencies in key jurisdictions to process in different fiat currencies and facilitate cross-border transactions without the need for counterparties while also enabling all players donate to causes this blockchain trusts.

TraXion has launched several products and services to prepare itself for this exciting event of involving the crowd in its mission. TraXion plans to have significant infrastructure in place prior to the initial coin offering (ICO). To date, TraXion has built four (4) of the six elements in the proposed economies of scale:

• Payment Platform

• Wallet

• Personal Finance Platform

• Fundraising Platform

• Payment Platform

• Wallet

• Personal Finance Platform

• Fundraising Platform

These four platforms will soon be on TraxionChain – connecting people to effectively transact payments, lower the cost of peer-to-peer lending and remittance, transparently account for philanthropic activities of non-profit organizations and enable insurance and investments processed more efficiently using smart contracts.

Traxion Mission

TraXion aims to fill the gap between the existing financial system and emerging non-user-friendly technologies by presenting a secure and simple way to use payments and banking architecture that aims to lower financial inclusion barriers and provide financial services to the banked and unbanked. Through the planned integration with MasterCard Service Provider, we will build the wallet that enables our user to store or transfer money to any card in the world. The sender and the receiver transact in the local currency and needs no awareness of cryptocurrencies or blockchain technology behind.

The Problem

• Financial inclusion

Financial inclusion is considered a key factor to poverty reduction. it refers to the access of people to a formal financial system. In the status quo, it’s the access to financial services such as banking that accounts for financial inclusion.

Unfortunately, Unfortunately, over 2 billion adults remain unbanked. In many of these developing regions, mobile money has taken the place of most financial services

Unfortunately, Unfortunately, over 2 billion adults remain unbanked. In many of these developing regions, mobile money has taken the place of most financial services

• Speed

the average time to complete a cross-border transaction is three to five business days, which includes the final mile transfer via a domestic payment network.

• Cost

The fees accumulate along the process of transferring the money to the end receiver. Charges increase as the transfer go through the bank where the senders request to, then another additional charge going through the central bank, and another accumulation when going across the border to the recipient’s country’s central and local bank respectively, counting the foreign exchange fees in the process.

• Bureaucracy

The existence of so many intermediaries, agents and brokers allow for the existence of bureaucracy in various workplaces. Current systems involve multiple agents to verify the data which makes the process complex. With the slow procedures and tedious work involved, many systems encourage this problem resulting to more problems like shortcuts and bribery which later on affects data integrity and accuracy of transactions.

• Transparency

The common woe when transactions are currently in transit is the process is not traceable. Senders and receivers are always left hopeful that the money will be delivered on time at very low costs. When the process of transfer from sender to receiver is not transparent, it leaves the people dumbfounded about the potential hazards that may happen along the way.

The Solution

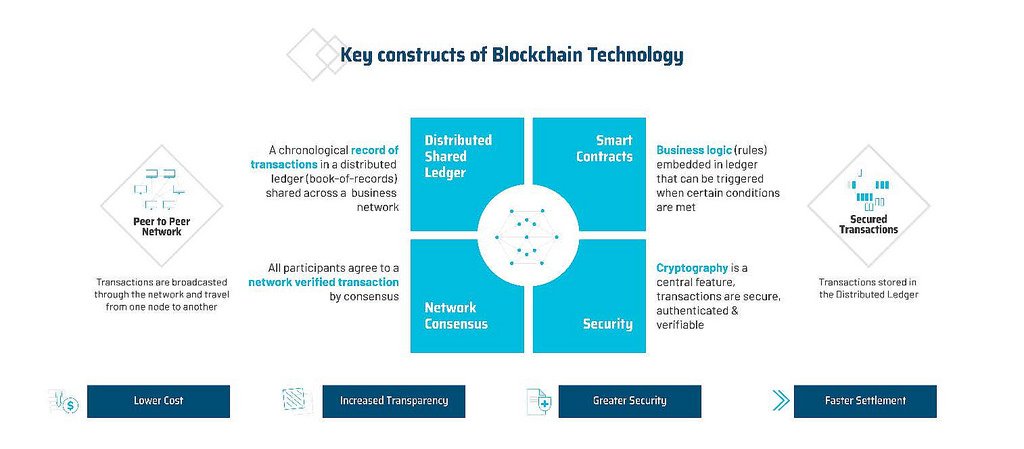

Blockchain aims to put data integrity among systems that don’t trust each other. This is the main reason why many start-ups are moving to decentralization, transparency and financial inclusion. There is a great potential of institutionalizing these technological developments in finance given the right approach and the proper creation of economies of scale within and among these systems.

• Hyperledger Fabric Blockchain

Hyperledger Fabric, an open-source blockchain is endorsed by a consortium of large tech enterprises such as IBM, Cisco, SAP, Intel and Oracle. Hyperledger Fabric project is delivering a blockchain platform designed to allow the exchange of an asset or the state of an asset to be consented upon, maintained, and viewed by all parties in a permissioned group. A key characteristic of Hyperledger Fabric is that the asset is defined digitally, with all participants simply agreeing on its representation/characterization.

The technology is based on a standard blockchain concept - a shared, replicated ledger. However, Hyperledger Fabric is based on a permissioned network, meaning all participants are required to be authenticated in order to participate and transact on the blockchain. Moreover, these identities can be used to govern certain levels of access control.

• Securing a Partnership with MasterCard

An initiative and a part of the roadmap of the TraXion team is to secure affiliation with banks who can link partnership with MasterCard for its solutions to TraXion token holders for payout solutions linking their Bitcoin, Ethereum, Monero, Zcash, Coin wallets to their own prepaid MasterCard which will enable P2P payments as well as access to over 130,000 ATMs in 196 countries around the world.

• Securing a Partnership with IBM

Companies of all sorts—including banks, tech firms, and retailers—have been building their own “chains” in the belief they will dramatically improve supply chains and lower the cost of record keeping. And here is where Hyperledger fabric comes in. Our chosen solution will make our integration and communication with the bank frictionless. Our partnership with IBM, being the leading technology provider to the banks, will greatly increase scalability of our services.

• Partnership with SEACOOP

TraXion will onboard up to a million seafarer members on the TraXionWallet which will ease the cooperative and its members’ mode of membership payments, investments, life and non-life insurances, and remittances.

• Platform Features

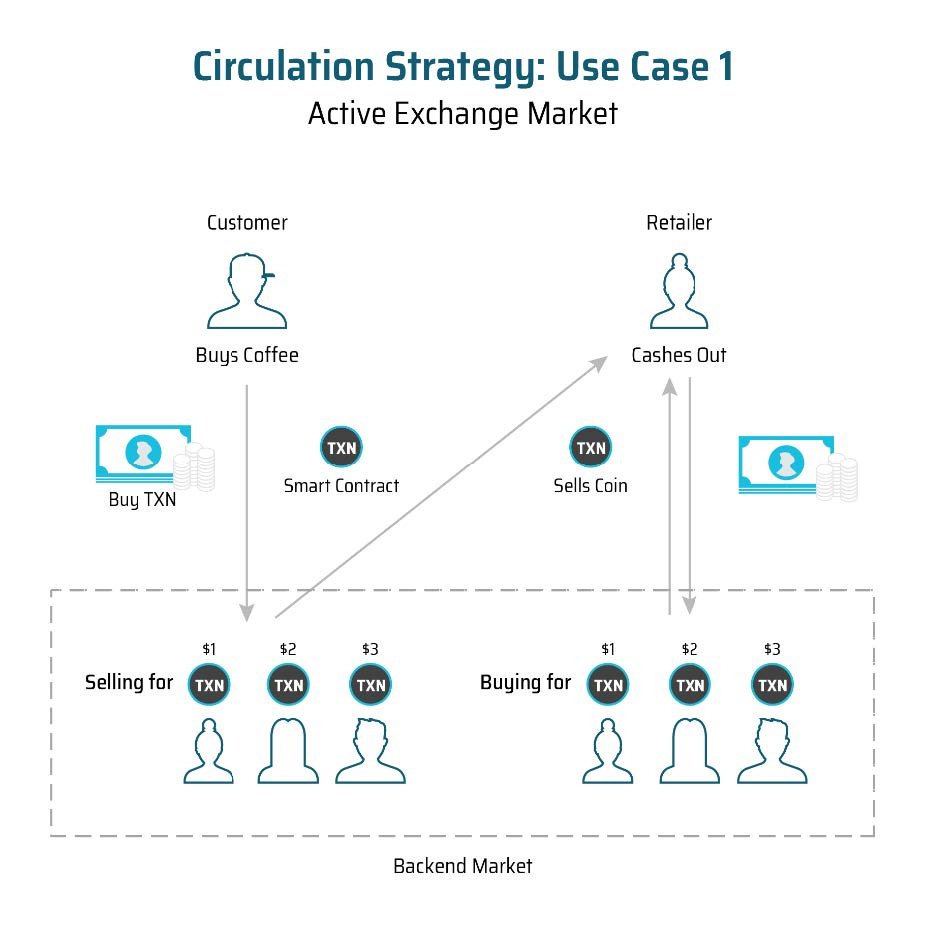

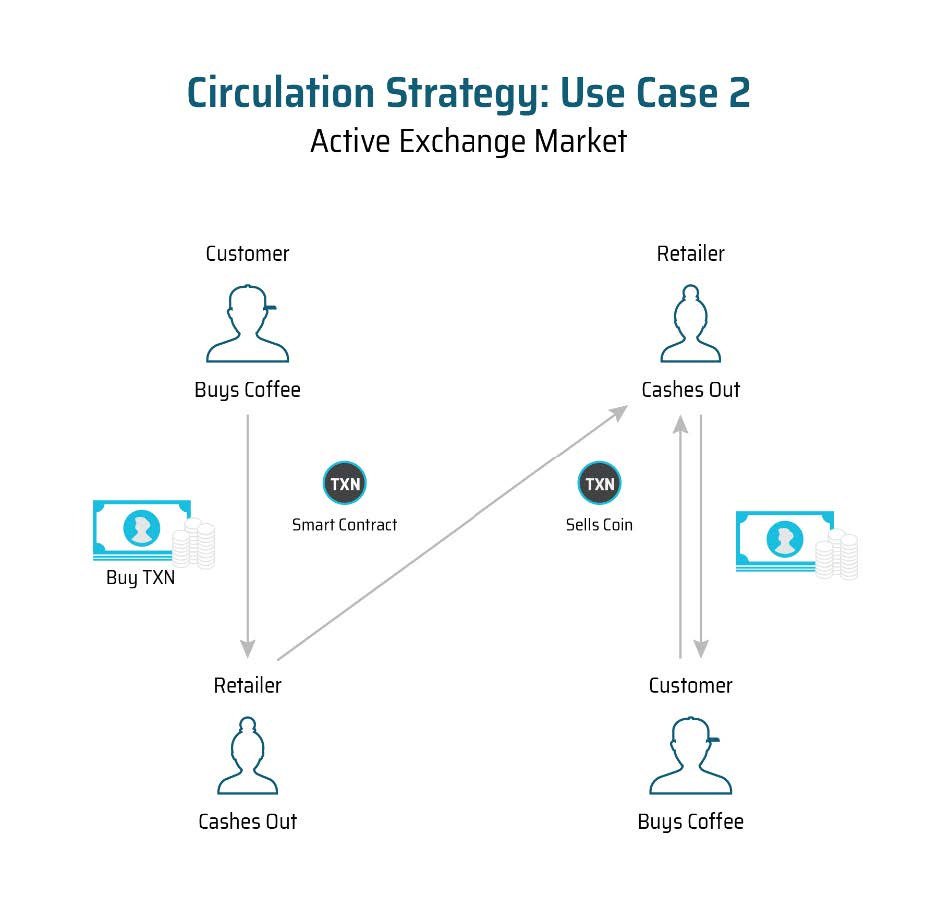

TraXion payments system is intended to simplify the way funds are exchanged around the world, and to reduce settlement time from days to seconds. Each payment is immutable once recorded, and settlement instructions are provided via smart contracts on Hyperledger Fabric.

The elimination of intermediaries and counterparties will naturally make any financial transaction gets through the network faster and cheaper.

- Borderless

- Cheaper

- Faster

- Agentless

- Global

- Scalable

- Auditable

- Smarter

Finally

TraXion aims to be a better bank in a blockchain-driven environment, enabling its community to load, send, save, spend, lend, borrow, and more using a secure, simplified yet compliant application. It is an environment where for-profit meets non-profit sectors and develops a synergy towards corruption-free social impact activities.

✅Website: https://traxion.tech/

✅Whitepaper: https://traxion.tech/documents/Traxion%20Whitepaper.pdf

✅Twitter: https://twitter.com/Traxiontoken

✅Facebook: https://www.facebook.com/Traxion.tech/

✅Reddit : https://www.reddit.com/user/TraxionICO/

✅Telegram Group: https://t.me/TraxionICO

✅Bitcointalk ANN: https://bitcointalk.org/index.php?topic=3043553.0

✅Whitepaper: https://traxion.tech/documents/Traxion%20Whitepaper.pdf

✅Twitter: https://twitter.com/Traxiontoken

✅Facebook: https://www.facebook.com/Traxion.tech/

✅Reddit : https://www.reddit.com/user/TraxionICO/

✅Telegram Group: https://t.me/TraxionICO

✅Bitcointalk ANN: https://bitcointalk.org/index.php?topic=3043553.0

Author of article:

✅Bitcointalk username: Erik_Smuel

✅Bitcointalk profile link: https://bitcointalk.org/index.php?action=profile;u=2020517

✅Bitcointalk username: Erik_Smuel

✅Bitcointalk profile link: https://bitcointalk.org/index.php?action=profile;u=2020517

No comments:

Post a Comment